- ETH price climbed higher nicely after forming a support base above $165 against the US Dollar.

- The price broke the key $175 and $180 resistance levels to move to a new yearly high near $188.

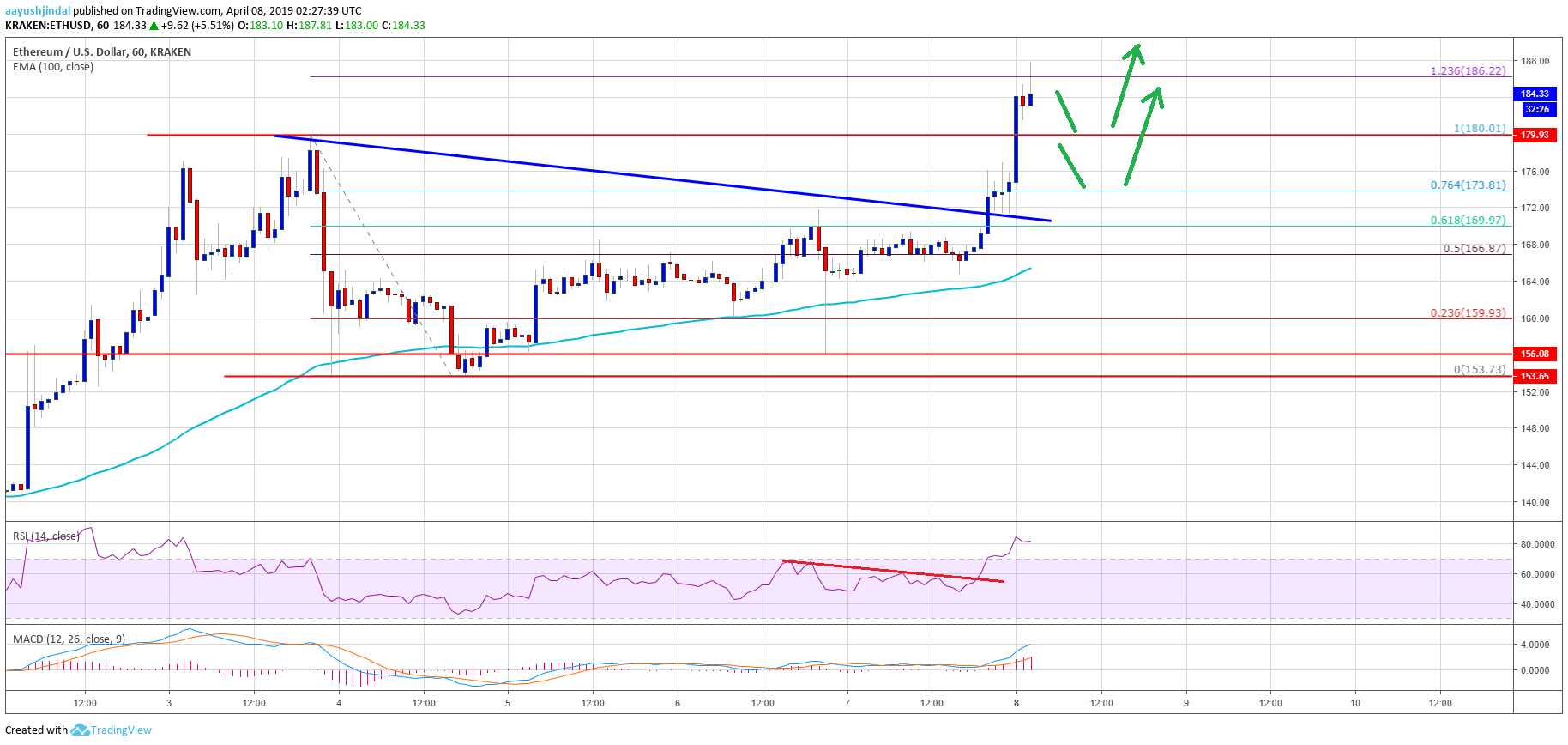

- There was a break above a major bearish trend line with resistance at $172 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair tested a crucial technical level and it might correct lower in the short term towards $180.

Ethereum price climbed to a new yearly high, with swing moves versus the US Dollar and bitcoin. ETH is likely to continue higher and buying dips close to $180 and $174 might be a good idea.

Ethereum Price Analysis

After a major downside correction, Ethereum price found support near the $154 area against the US Dollar. The ETH/USD pair rebounded and slowly climbed above the $164 and $165 resistance levels. Later, there was a close above the $168 level and the 100 hourly simple moving average. Buyers gained control and pushed the price above the 61.8% Fib retracement level of the last drop from the $180 high to $154 swing low. It opened the doors for more gains above the $175 and $180 resistance levels.

Besides, there was a break above a major bearish trend line with resistance at $172 on the hourly chart of ETH/USD. The pair broke the last swing high near $180 and traded to a new yearly high near $188. More importantly, it tested the 1.236 Fib extension level of the last drop from the $180 high to $154 swing low. At the outset, the price seems to be consolidating gains near $185. It could correct a few points towards the $180 support in the near term (the previous resistance).

If there is a downside extension, the price may even correct towards the $175 or $174 support area. The price remains well supported on dips and it seems like $180 or $175 support is likely to act as a strong buying area. On the upside, the price could surge above the $188 and $190 resistance levels. The next stop for Ethereum may be $200, where sellers are likely to emerge.

Looking at the chart, Ethereum price clearly broke to the upside above the $175 and $180 resistance levels. Both the stated levels are likely to act as supports if the price corrects lower from $188. Overall, the price is trading with a positive bias, with chances of more gains above $190.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining strength in the bullish zone.

Hourly RSI – The RSI for ETH/USD broke a bearish trend line and climbed sharply above the 75 level.

Major Support Level – $180

Major Resistance Level – $190

The post Ethereum (ETH) Price Signaling Bullish Breakout, Buying Dips Favored appeared first on NewsBTC.

* First published on newsbtc.com