- ETH price failed to break the $139 resistance and declined sharply against the US Dollar.

- The price broke the key $134 support level to enter a bearish zone.

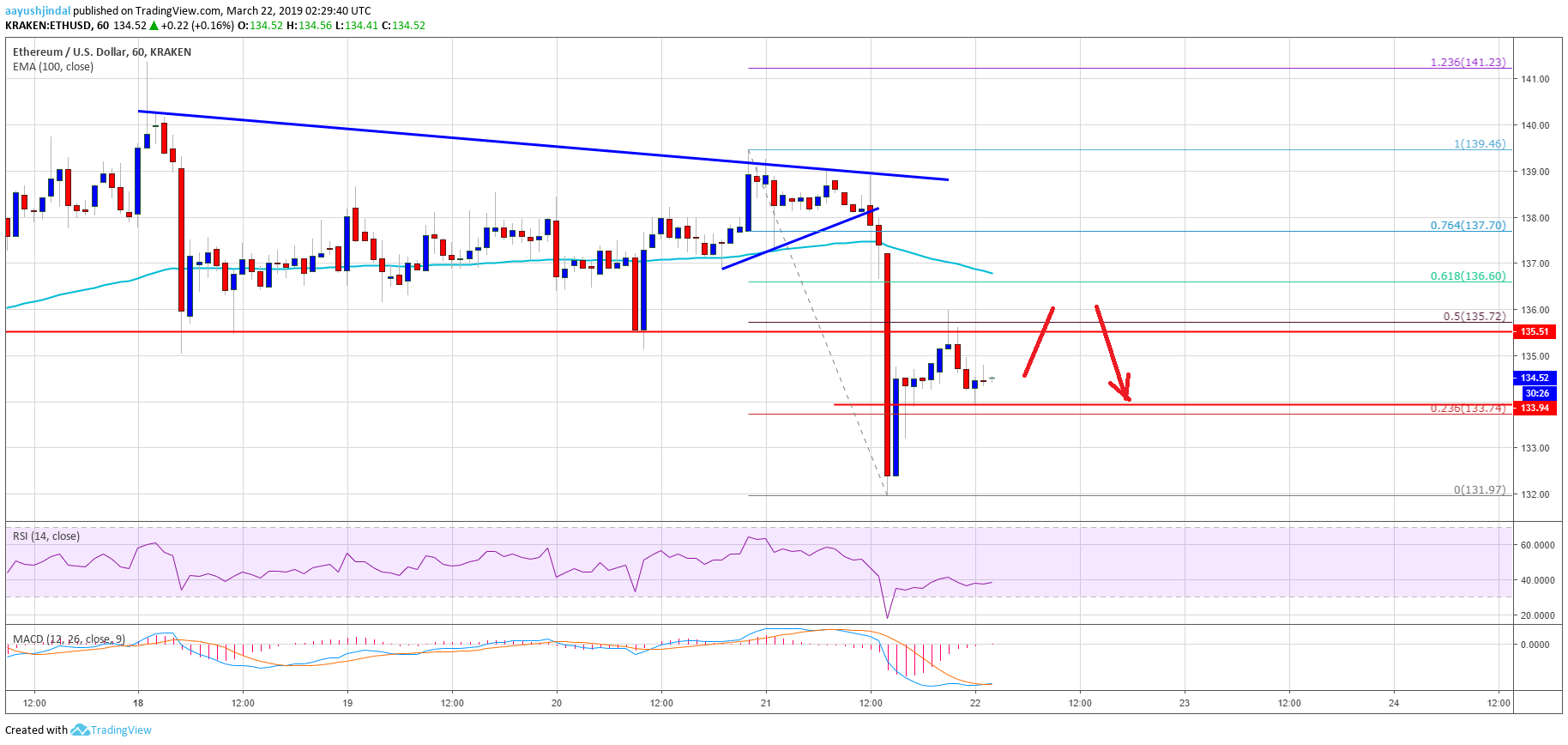

- A new connecting bearish trend line is formed with resistance at $139 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair is likely to struggle near the $135 and $136 levels if it corrects higher in the near term.

Ethereum price declined sharply below key supports against the US Dollar and bitcoin. ETH settled below $136 and the 100 hourly SMA, which is a short-term bearish sign.

Ethereum Price Analysis

There was another attempt by ETH price to climb above the $139-140 resistance area against the US Dollar. The ETH/USD pair failed to surpass the $140 resistance and later started a downside move. There were range moves above $138 before sellers took charge and pushed the price below $136 and the 100 hourly simple moving average. There was a break below a connecting bullish trend line at $138 on the hourly chart, opening the doors for more losses.

As a result, there was a sharp decline and the price tumbled below the $134 support level. The price traded towards the $132 support and settled below the 100 hourly simple moving average. Recently, it corrected higher above the $133 level and the 23.6% Fib retracement level of the last drop from the $140 swing high to $132 low. Buyers even pushed the price above the $134 level, but upsides were capped by the $136 resistance. Besides, the 50% Fib retracement level of the last drop from the $140 swing high to $132 low acted as a resistance.

It seems like the previous support area near $136 is acting as a solid resistance. Therefore, the price may consolidate in the short term before it makes another attempt to clear the $136 level. On the upside, the next resistance is near $137 and the 100 hourly SMA. Moreover, there is a new connecting bearish trend line is forming with resistance at $139 on the hourly chart of ETH/USD.

Looking at the chart, ETH price clearly moved into a bearish zone below the $136 support and the 100 hourly SMA. If buyers struggle to push the price back above the $136 and $137 levels, there is a risk of more downsides. An initial support is near $134, below which the price may revisit the $132 swing low.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is about to move into the bullish zone.

Hourly RSI – The RSI for ETH/USD declined below the 50 level and it is currently below the 40 level.

Major Support Level – $132

Major Resistance Level – $137

The post Ethereum Price Analysis: Stop Hunting Pushes ETH Into Bearish Zone appeared first on NewsBTC.

* First published on newsbtc.com